I’ve always considered myself a relatively high-energy person.

Not in the overly hyper, “Kim, would you settle down” kind of way (although some of my lifelong friends might remember times when they wished I’d settle down).

More in the “let’s get sh*t done kind of way.”

I still like getting things done, but I value my downtime much more than I did when I was younger (maybe it’s because when we’re younger, it feels like we have an infinite amount of time?).

Because of this appreciation for downtime (I’m counting the days until I can float in the pool and read a book), I’m very protective of my energy.

The only time I feel tired is when I’ve woken up at “too early o’clock” because, well… menopause- or when I’ve done a lot of physical work and my body crashes at night (that’s a good kind of tired).

But, there’s a particular kind of tired that creeps in when the world feels like too much. Not the exhaustion that sleep can fix, but the kind that lingers in your bones, whispering that something isn’t quite aligned.

Lately, I’ve noticed this among some of the women I talk to—the quiet, accumulating fatigue that builds not just from doing too much, but from doing too much of what no longer lights us up.

(At the same time, I can’t help but feel like there’s a phoenix rising… among many women. We’ll talk about that next week).

Here’s the twist: it’s not just about time or tasks or even responsibilities. It’s about energy—how we spend it, how we protect it, and how it’s tied, inextricably, to our relationship with money.

The term “energy audit” might sound like something from a sustainability report, but I’ve come to think of it as an essential practice in modern financial well-being. When the noise of the world grows louder—political instability, economic fluctuations, rising costs, constant demands for our attention—there’s real power in turning inward and asking: Where is my energy going? And just as important, is it taking my money with it?

This isn’t about shame. It’s about curiosity. About honesty. And about liberation.

Money is often taught as a math problem, but most of us know—especially those of us with some life experience behind us—that it’s more like a mirror. It reflects what we believe we’re worth, what we’re afraid of, what we’re craving, and how safe (or unsafe) we feel in the world.

The neuroscience confirms it.

Decisions made under stress fire up the brain’s oldest operating systems—those fight-or-flight centers designed to keep us alive, not aligned. When your nervous system is hijacked by cortisol, you’re not budgeting—you’re bracing. You're not investing—you’re escaping. You're not saving—you’re surviving.

And yet, in the blur of survival, we rarely pause to examine the deeper economy at play: the one that measures cost in energy, not dollars.

So what does that look like in practice?

It looks like noticing how you feel when you open your banking app.

Do your shoulders tense?

Does your stomach knot?

Or do you breeze through, no big deal?

These are not minor inconveniences. They are energetic red flags.

We’ve been taught to chase ROI—the return on investment. But I’ve started chasing ROE instead: return on energy.

Not everything that pays you is worth the toll it takes on your nervous system. And not everything that energizes you comes with a paycheck—yet those things often lead to better choices, stronger boundaries, and more sustainable wealth.

In uncertain times, the instinct is to tighten up, grip harder, and double down on what feels familiar. But what’s familiar isn’t always what’s fueling us.

More often, it’s what’s draining us.

What if clarity didn’t come from doing more, but from pausing?

From asking: What gives me life right now? What’s depleting me? What would feel nourishing, not just financially, but energetically? (And sometimes a glass of wine or chocolate is nourishing, too.😉)

We talk about building wealth but rarely about sustaining it, about earning in ways that energize us, spending in ways that reflect our values, and resting in ways that restore our capacity to receive.

This work doesn’t live in spreadsheets. It lives in our bodies, our calendars, and our inner dialogue.

Maybe the empire you were building doesn’t fit anymore. That doesn’t mean you’re behind. It means you’re awake.

The women I admire most are the ones who lead from alignment, not urgency, who earn from who they are, not just what they do.

So, if you feel the pull to slow down, take it. You don’t need to earn your rest or permission to realign.

The most powerful thing you can do with your money isn’t just manage it—it’s to let it move through a life that actually feels good to live.

And that?

That’s wealth.

A Woman You Should Know

Dr. Tara Brach

Dr. Tara Brach is a psychologist, author, and beloved mindfulness teacher whose work is deeply relevant to our relationship with money, especially in navigating fear, shame, and scarcity. Her signature RAIN practice (Recognize, Allow, Investigate, Nurture) offers a compassionate way to pause and meet ourselves with presence rather than judgment. While she doesn’t speak directly about finances, her teachings are a powerful guide for creating space between impulse and action—an essential skill in money and life.

Website: www.tarabrach.com

Podcast: Tara Brach – available on all major platforms

Money Moves

Do an Energy Audit of Your Expenses

Look at your last 30 days of spending—not through the lens of guilt or control, but energy. What purchases felt expansive, nourishing, or aligned with who you’re becoming? Which ones felt draining, resentful, or rooted in obligation?

Pick one small shift you can make: cancel a subscription you forgot you had, bump a service provider who no longer aligns, or set a new threshold for impulse buys. The goal isn’t restriction—it’s reclamation.

Resources

Book – The Energy of Money by Maria Nemeth

A classic for a reason. Nemeth weaves together practical financial advice and deep personal insight, showing how energy leaks, limiting beliefs, and unresolved emotions block our ability to create sustainable wealth.Podcast – F*ck Saving Face* with Judy Tsuei

This podcast is a bold, compassionate space for unlearning cultural expectations—especially for AAPI women and women of color—and rewriting narratives around identity, success, and worth. Judy explores themes like hustle culture, self-trust, and what it means to thrive without betraying yourself. A must-listen if you’re redefining your relationship to productivity and permission.Product - I love this toothpaste. I actually found it on TikTok! NOBS is everything toothpaste should be - all the good stuff, and none of the junk. Never any fluoride, and no harsh abrasives. 5% nano-hydroxyapatite to protect your teeth long-term. It's the safest alternative to fluoride!

Check out NOBS here.

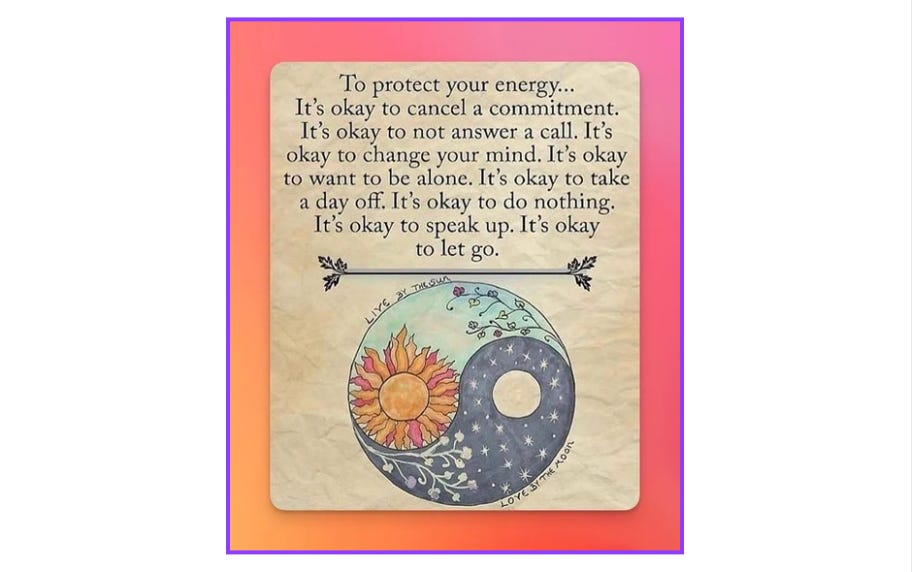

Protect Your Energy

You don’t need to overhaul your entire life to feel better about your money—you just need to start paying attention to what actually works for you.

Energy is information.

If something feels off, it probably is. Trust that. Make one shift this week that feels aligned, not obligated.

With love & abundance,

Kim